Choosing the right trading software can be a daunting task. There are dozens of existing trading platforms on the market, all touting killer features and unbeatable performance. Some are desktop-only, some are online-only, some are hybrid, but only a few are designed for professional Direct Market Access trading in Equities. And of those, only a handful have the full feature set, robustness and dependability required in today’s market.

In this series of articles we will attempt to help current and prospective traders make the best choice for their trading style and showcase some of the main features of the trading platforms that we offer.

Today’s feature introduces another premier DMA platform veteran - DAS Trader. Direct Access Software (DAS) has provided high quality trading technology for over 20 years; let’s take a look at why professional traders continue to value their solutions to this day.

Like all premier trading software, DAS is feature-rich, covers all the main pro trading functions and provides deep customizability. You will recognize the usual hallmarks of premier trading software here - extensive customization, modular, loadable layouts with window linking, catering to experienced traders that like to set up their workstation to suit their specific trading style.

Unlike many other platforms on the other hand, DAS offers a minimalist appearance and design ethos, allowing traders to create clean, information dense trading stations tailor-fit to their trading style. Known for its emphasis on workflow customization, DAS is a favorite for advanced traders that prefer to trade by keyboard, making extensive use of hotkey shortcuts and pre-set trading behaviors (action-set templates) that can be triggered by keys. If you’re a speedy trader that prefers to stick to a set of go-to action-chains, this might be the platform for you. Let’s take a closer look!

Layout

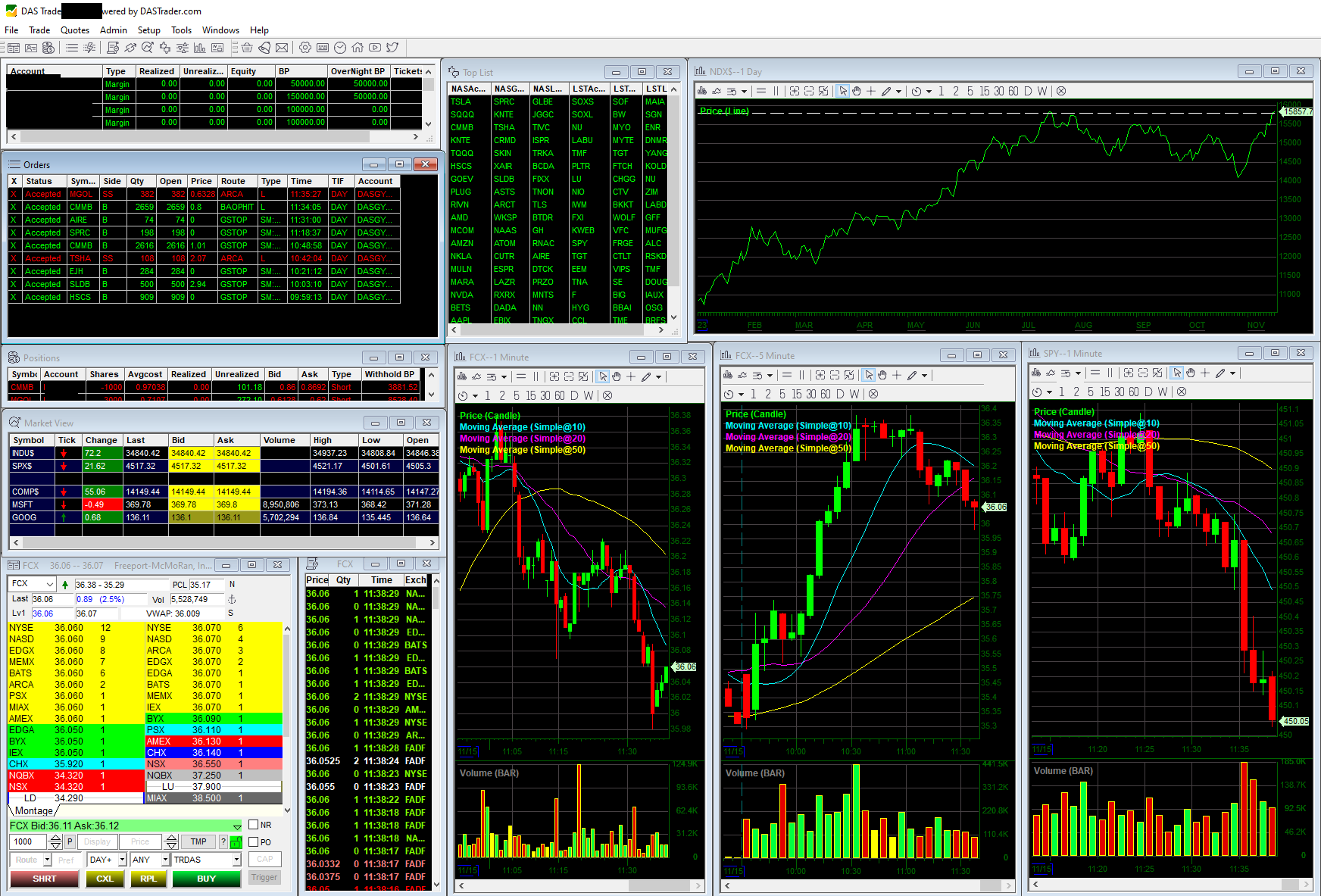

Professional trader layouts range from simple and laser-focused to obscenely complex and information dense, depending on the trader’s strategy and workflow. To cater to the wide gamut of trading styles in equities & options trading, most professional platforms employ a modular approach, allowing you to “build your own workstation”.

Some platforms take a more generalist approach with limited customization, trying to fit as much as possible on every window to cater to every trading style. DAS takes a more personal approach, giving you more freedom to pick and choose what you want to see and use in every window, and leave the “noise” out.

- Features and functions are separated into logical windows, that snap together to form a workspace

- Windows that a trader would usually have multiples of (chart, time & sales, order entry) can be grouped together to sync with each other. Actions in one will update all others.

- Save & Load layouts to switch between workstations or strategies on the fly.

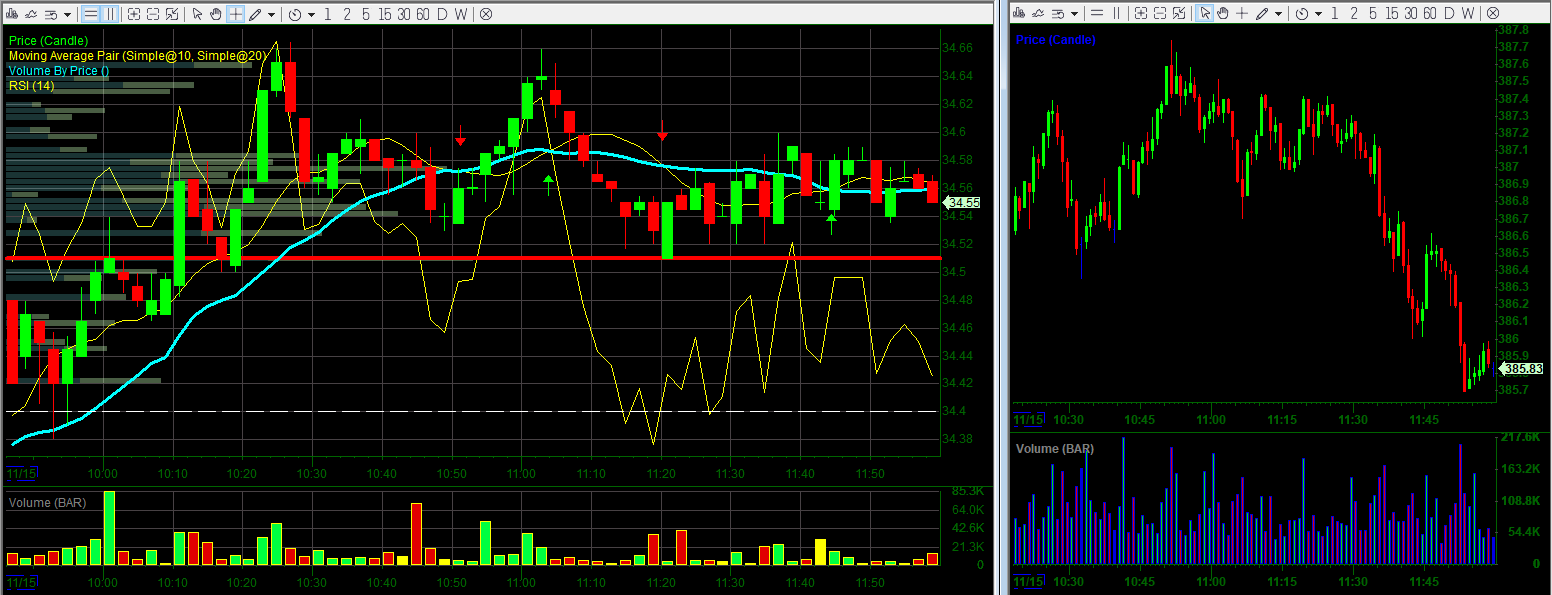

Charting

Charting is a fundamental feature of trading platforms, and surprisingly not all of them do it well. DAS charts are clean and efficient, with a minimalist look. They don’t offer the same depth of analysis and studies that some other platforms do, but they strike an excellent balance that will serve all but the most technical-analysis driven traders.

- Clean, minimalist charts with the usual number of timeframes, but sticks to the candlestick style

- Offers 40 of the more popular analysis studies, in a well executed manner

- Supports a large number of simultaneous charts

- Almost every aspect of the chart is customizable to your liking - not just colors and weights!

Portfolio & Order Management

DAS offers all the order options used by professional traders, but in keeping with its design ethos, it doesn’t throw them all at you at once. DAS order entry might be the most customizable we’ve come across at Zimtra. Moreover, position, portfolio and order windows are presented in a very compact and centralized manner.

- All order entry basics you’d expect - symbol, quantity, price, TIF (Time in Force) and Route selection

- Access to ALL primary exchange order types (NYSE, NSDQ, ARCA, BATS, EDGA, EDGX, etc), plus all the major dark pool strategies and providers

- Advanced features are accessible in one click via customizable “Styles” - including Stop, Option, One-Cancels-Other Pair and Advanced.

- Position monitor, Portfolio monitor and Order manager are presented in a very minimalist, information dense manner - with minimal noise.

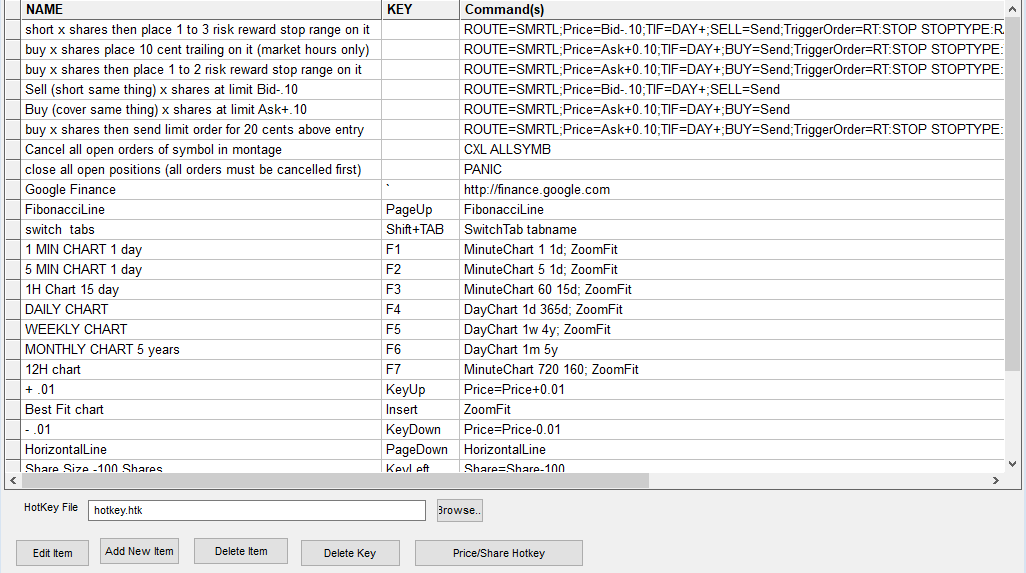

Hotkeys & Action-Scripts

Where most professional platforms offer just the customary hot-key functionality, with various degrees of complexity and robustness, one of the main aspects that differentiates DAS - is an emphasis on empowering professional traders to replace almost everything they do in the platform with hotkeys and scripts. DAS allows you to trade advanced strategies without ever touching your mouse - making lightning fast trading styles a breeze.

Most platforms allow you to map functions and commands to a combination of key strokes. DAS goes a few steps further, letting you script entire chains of actions, and bind them to one hotkey. And not just actions. You can define variables and use logic in your scripts!

- Unparalleled workflow scripting & deeply advanced hotkey support

- Bind order entry presets, including all order entry variables, into one action and map it to a key (or combination of keys)

- Script actions in multiple windows into one workflow - like macros in Excel!

- Save, load and share hotkey profiles, bindable to layouts

Market Data

There is no way around it - market data is every trader’s main window into the market. DAS is a preferred data reseller for NASDAQ, and a market data vendor to all major exchanges. Although DAS does not operate rebroadcast servers outside the United States like Sterling, it does broadcast data feeds from its hub collocated at NASDAQ, and has private fiber lines to all major exchanges. Zimtra has never experienced complaints from traders regarding DAS market data. Offering some unique data features and competitive feed pricing, DAS is a strong option for value-conscious traders.

- Top tier ultra-low latency realtime market data feeds for all major exchanges

- Excellent options for customizing how you prefer your data to be displayed - not just colors and price band sizes

- FundaSome niche features, like Data Replay, which allows you to replay realtime data for a given symbol at a past point in timemental Data Monitor

- DAS offers data feeds at market price, but has some unique bundles savings - for example, all three L1 data feeds (NYSE, AMEX, NASDAQ) for $65.33 - big savings over competitors.

- Imbalance, Fundamental data and News services are all available

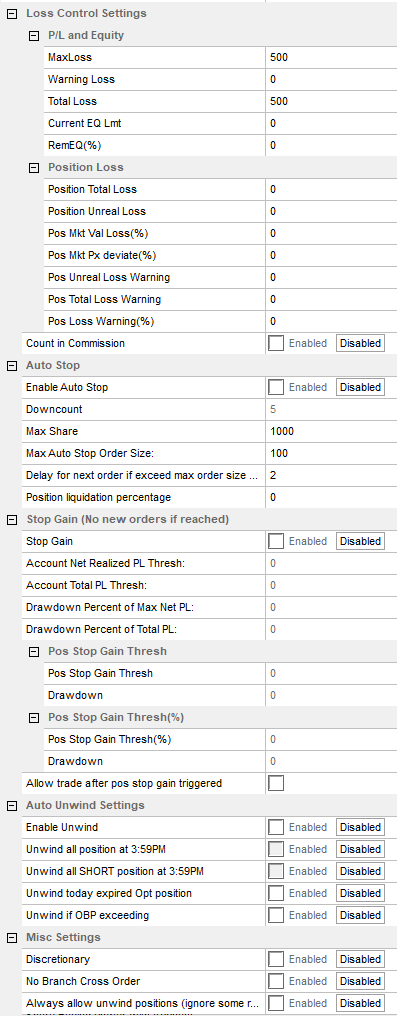

Risk Management

One stand-out reason why some traders choose DAS - lies in its risk-management features. Unlike most software, which has limited risk management options (usually only daily max loss limit), DAS offers the most extensive and proptrading-friendly selection of features. This enables our team to offer convenience and peace of mind to traders that prefer these features.

- The usual daily max loss and global max loss limits, triggering closing-orders-only mode (allowing you to only reduce or close positions once reached)

- Per-position / per symbol max loss and maximum position size

- Global and per-position auto-liquidate feature (closes your positions automatically when maximum loss is reached)

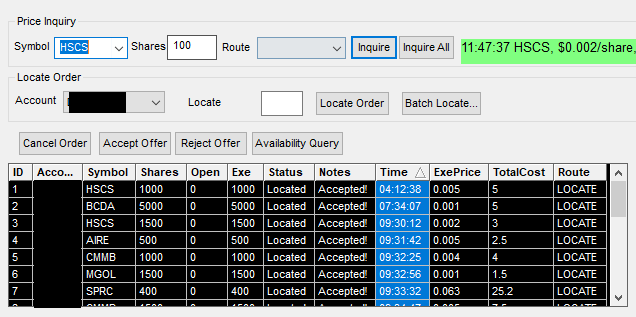

Locates & Easy-to-Borrow

Like all true professional solutions, DAS offers a full locate monitor facility, and fully supports Zimtra’s easy-to-borrow list.

Extensibility & Support

True to its name, DAS offers excellent API trading support in multiple programming languages. Zimtra traders successfully run algorithmic trading strategies through DAS with minimal complaints, and DAS offers good documentation for you to implement your own solution.

Although not at the level of the top-tier platform Zimtra offers, DAS does offer excellent and timely support for trader issues. In our experience, it is rarely required, and the Zimtra support team is well equipped to answer the vast majority of support-related inquiries. Moreover - DAS has one of the best resource portals in the industry! With an extensive library of training videos and an exhaustively-documented manual (also one of the best we’ve seen!), this is a platform you can start using with confidence.

Conclusion

The Direct Market Access software market is full of offerings, but not all are created equal, and not all are suitable for every type of trader. Every major competitor offers something different.

DAS Trader is an outstanding choice for traders that seek very high customizability, premier performance & reliability, or just prefer a minimalist interface that they can tailor-fit specifically for their strategy and trading style, leaving out anything that they do not regularly use. For a focused trader, or someone used to trading primarily with hotkeys or a set of prepared strategies that can be executed with extreme speed and precision - DAS is a clear choice.

Open your live account today!