The minimum performance bond required to start trading with Zimtra is $2,000.

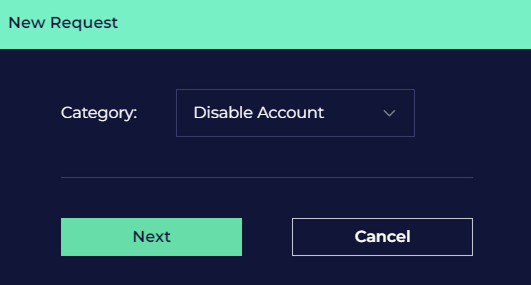

We allow your account to draw down to 40-50% of this amount. Once the balance reaches this level, our team reserves the right to close any open positions, disable the account, and notify you of the low-performance bond balance. At that point, we will request that you wire at least the amount necessary to restore the performance bond to the minimum of $2,000.

By default, any profits over $500 per month will be paid out, provided you have previously submitted your wire details to us. If we do not have your wire information, the profit will be added to your performance bond balance.

If you prefer, you can inform us that you would like your profits to be automatically added to your performance bond. This will lead to higher trading limits, with payouts being processed only upon your request.

Profit payouts typically occur once a month, between when the statements are uploaded and the 1st day of the following month.

You can withdraw funds from your account at any time by submitting a request to our support team with the desired amount, and completing

the wire template. These requests are processed on a best-efforts basis, usually within 1-3 days. Please note that a decrease in your performance bond balance will result in reduced risk limits on your trading account.

We primarily use WISE for sending and receiving funds. If, for any reason, we are unable to use WISE, we will use one of our traditional bank accounts, which may incur additional bank charges.

Important note: Wire transfers to fund your account must be sent from a bank account held by the same entity that has an agreement with Zimtra. If you open an account as an individual, we cannot accept funds from any other company, including one registered in your name. If you wish to open an account on behalf of a company, please contact our support team for guidance on how to proceed. Additionally, any profit payouts or withdrawals can only be made to bank accounts in the name of the entity with which we have an agreement.

Fees for Wires Received by Zimtra

$6.11 (charged by WISE).

Fees for Wires Sent by Zimtra

All wire fees are assessed by the bank and are passed through without markup. All fees are listed in USD.

Wires: $9.03 (Fixed Fee)

Bank Debit (ACH): $2.92 (Fixed Fee) + 0.25% (Variable Fee)

Fees may vary by country. Please consult the WISE website for specific charges.